Earning an average salary is often considered a mark of financial stability and success. Many people believe that as long as they have a steady income, they are secure and will eventually achieve financial well-being. However, the reality is that numerous individuals struggle financially despite earning a salary that is considered average or even above average.

The challenge is not solely about how much one earns but how effectively one manages that income. Financial stability is influenced by a complex interplay of factors beyond just salary, including spending habits, financial literacy, debt management, and economic conditions.

This article delves into the reasons why people become poor even while earning an average salary, supported by data and research.

1. Lack of Financial Literacy

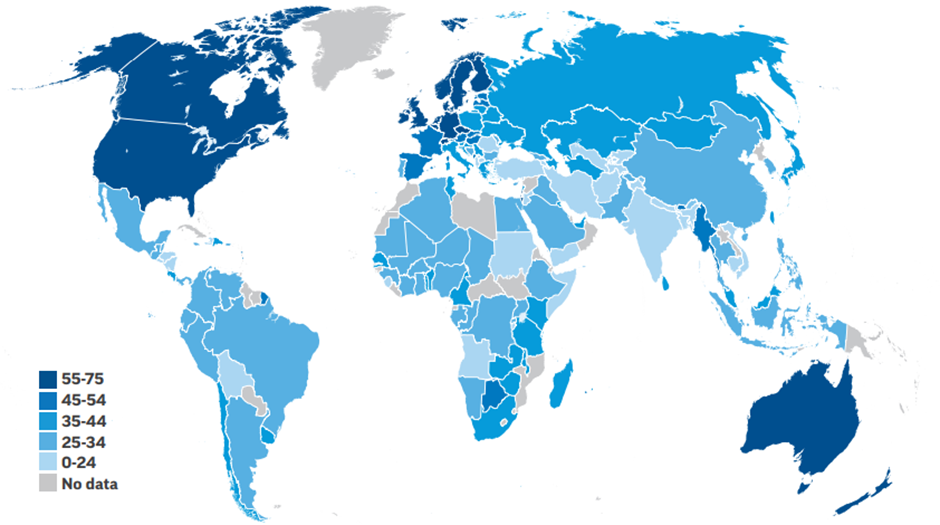

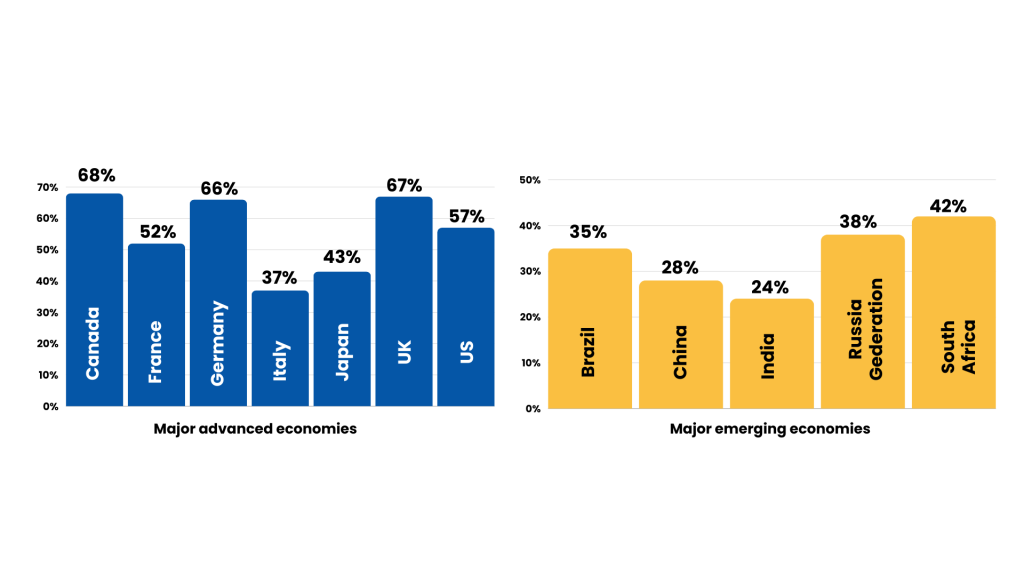

According to a Standard & Poor’s Ratings Services Global Financial Literacy Survey (S&P Global FinLit Survey), only 24% of Indians are financially literate. And worldwide, only 1-in-3 adults are financially literate.

Financial literacy involves understanding basic financial concepts such as budgeting, saving, investing, and debt management. A lack of financial literacy can lead to poor financial decisions, such as overspending and inadequate saving for emergencies.

For example, many individuals do not understand the impact of compound interest on debt, leading them to accumulate high-interest debt without a clear repayment plan.

Given below is a chart showing the percentage of financially literate individuals in various countries.

GLOBAL VARIATIONS IN FINANCIAL LITERACY (% of adults who are financially literate)

Source: S&P Global FinLit Survey

VARIATION IN FINANCIAL LITERACY AROUND THE WORLD (% of adults who are financially literate)

Source: S&P Global FinLit Survey

2. High Cost of Living

The cost-of-living index in major Indian cities like Mumbai and Delhi is significantly higher than the national average.

According to Mercer’s 2024 Cost of Living survey, Mumbai and Delhi are amongst the most expensive cities in the world. Mumbai is ranked 136th and Delhi is ranked 165th among 226 cities across the world, with Hong Kong and Singapore remaining in the first and second positions.

High living costs in urban areas can erode disposable income, making it difficult to save and invest. Housing, transportation, and healthcare are major contributors to the high cost of living.

For example, a family earning an average salary in Mumbai might spend over 50% of their income on rent alone, leaving little room for savings or investments.

3. Debt Burden

As per a Nov 2023 report named “Global Debt Monitor” by the Institute of International Finance (IIF), household debt in India has been steadily increasing, reaching a peak of 41.1% of GDP in Q3 2023.

Here’s a bar graph showing the data of household debt as a percentage of GDP across different countries.

Household Debt (% of GDP)

Sources: IIF, BIS, Haver, National Sources

High levels of personal debt, including credit card debt, personal loans, and EMIs, can significantly reduce an individual’s net income. Interest payments can consume a large portion of monthly earnings, leaving little for other expenses or savings.

An individual with multiple EMIs and credit card payments might find themselves with negligible savings despite a reasonable salary.

4. Inflation

Inflation in India averaged 6.62% in 2020, impacting purchasing power.

Inflation erodes the purchasing power of money, meaning that the same salary buys fewer goods and services over time. If salary increments do not keep pace with inflation, individuals effectively become poorer.

For example, a salary increase of 3% in a year with 6% inflation actually represents a decrease in real income.

5. Lifestyle Inflation

There is a trend that many Indians increase their spending as their income rises.

Lifestyle inflation occurs when people spend more as they earn more. Instead of saving or investing additional income, individuals upgrade their lifestyle, which can lead to financial strain if income decreases or unexpected expenses arise. For instance, an individual who upgrades to a more expensive car or house with each salary hike might find themselves with little financial cushion during tough times.

Another factor which contributes to lifestyle inflation is entitlement. Since you would have worked hard for your money, you feel justified to spend more and treat yourself to better things.

6. Lack of Emergency Fund

Around 75% of Indians do not have an emergency fund, according to a survey by personal finance platform Finology.

An emergency fund is crucial for financial stability. Without it, unexpected expenses such as medical emergencies, car repairs, or job loss can lead to significant financial distress and accumulation of debt.

An individual without an emergency fund might have to rely on high-interest loans or credit cards to cover unexpected expenses, exacerbating financial problems.

7. Inadequate Retirement Planning

According to Max Life Insurance – India Retirement Index Study (IRIS) 3.0, some major insights about the preparedness of Indians for their retirement years can be drawn.

Source: India Retirement Index Study (IRIS) 2023

Inadequate retirement planning can lead to financial insecurity in old age. Many people fail to start saving for retirement early enough, leading to insufficient funds when they retire. An individual who does not invest in retirement funds during their working years may struggle to maintain their standard of living post-retirement.

Ready to grow your wealth?

Partner with Fincart for expert investment planning and make your money work for you.

Solutions to avoid financial struggles

To avoid financial struggles despite earning an average salary, individuals can adopt the following strategies:

- Attend financial education workshops and courses

- Set realistic financial goals and allocate funds accordingly

- Track income and expenses to understand spending habits

- Prioritize paying off high-interest debt first

- Aim to save at least 3-6 months’ worth of living expenses

- Start contributing to retirement funds as early as possible

- Take advantage of employer-sponsored retirement plans

- Resist the urge to increase spending with income hikes

- Prioritize needs over wants when making spending decisions

- Educate yourself about different investment options

- Diversify your investment portfolio to minimize risk

Conclusion

Earning an average salary does not guarantee financial stability. Factors such as lack of financial literacy, high cost of living, debt burden, inflation, lifestyle inflation, lack of emergency fund, and inadequate retirement planning can all contribute to financial difficulties. By understanding and addressing these factors, individuals can better manage their finances and avoid becoming poor despite earning an average salary.

At Fincart, we understand the unique challenges faced by individuals. Our expert advisors can help you optimize your finances through personalized guidance. Contact us today!