Table of Contents

ToggleWhat is the right time to instil the concept of morality, ethics, and values in a child? Your answer would probably be – when the child is young. When the child is young he/she is more likely to encapsulate these principles in his/her character and grow up to be a responsible human being. If the child is grown up and lacks ethics and values, no matter the lessons you give, they will fail to make their impact.

This is the importance of starting early and even in the case of investments, the same thing applies. There is no concept of the ‘best age’ to start investing. The earlier you start the better. As soon as you become financially independent and start making an income, you should develop the practice of saving and investing. The reasons are as follows –

1. Longer investment horizon

When you start investing from an early age, your financial goals will be far off. For example, if you start investing at, say, 23 years of age, it would be some time before you marry or when you plan a child. So, the requirement of a financial corpus would not be immediate or urgent. This would give you a longer time to invest. As the investment horizon increases, returns increase, giving you a larger corpus.

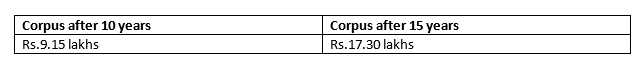

For example, say, you invest Rs.5000 every month at and risk-free rate of interest of 8% per annum

Just a difference of 5 years and the corpus is almost halved! Thus, if you give your investments time, the compounding of returns would help in creating a substantial corpus over the investment period.

2. Smaller savings

When you start investing early, you can invest small amounts regularly and still create a considerable corpus over the years. This is a corollary of the above point.

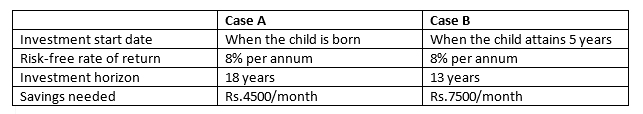

Suppose you need to create a corpus of Rs.20 lakhs for your child’s MBA when your child is 18 years old. See these two cases –

When you start saving early, you can create a corpus of Rs.20 lakhs by saving Rs.4500 every month. But if you delay your investments by 5 years, the required savings increase by 166.67% and you need to save Rs.7500/month to attain the targeted corpus.

At later stages, your responsibilities increase making it difficult for you to put aside considerable amounts for your child’s future. As such, ultimately, your financial planning is jeopardized and you fail to meet your goals.

The early bird catches the worm. You must have heard this saying. Just like with everything else in life, the saying applies to investments too. The earlier you start investing the better the corpus that you can accumulate.

The most common reason why many individuals are not financially healthy is procrastination. They delay their investments for instant gratifications which, ultimately, results in insufficient funds for their financial goals. You, however, have been warned!

Start investing as soon as you start earning. Even though your income might be limited in the initial years, so would your responsibilities. Invest a part of your income every month to create a considerable corpus for your future financial goals.

Choose investment avenues that give attractive returns and are also tax-efficient. Try and take the assistance of certified investment planners or certified financial advisors who can provide their expert guidance on –

- How to Invest?

- How much to Invest?

- Where to Invest?

For how long to invest Plan your finances with the help of financial planners and create a diversified portfolio. But, start young and start at the earliest.