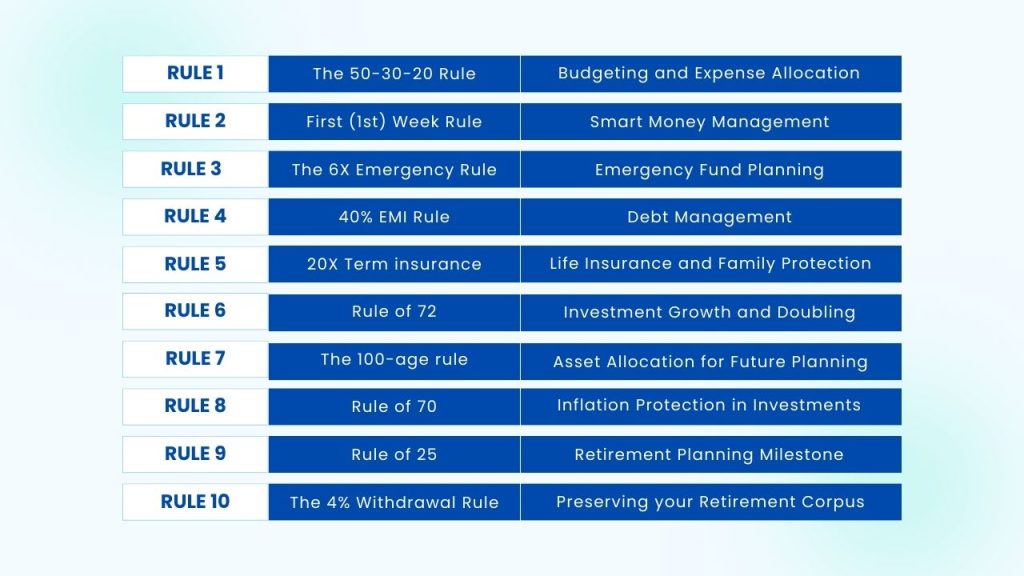

Table of Contents

ToggleWhen it comes to managing money, everybody just simply wants a hack that can multiply their money manifolds. But wealth creation is not a two-minute exercise, rather it is a comprehensive process that involves a balance of budgeting, investing and saving. In fact, there are some thumb rules of personal finance that can guide you towards a secure financial future. Whether you’re just starting out on your financial journey or are already on the path, looking to refine your existing strategies, these easy-to-follow rules can provide a solid foundation for achieving your monetary goals.

Let’s explore the top 10 rules that can transform your financial journey and help you manage your money wisely:

1) The 50-30-20 Rule

The 50-30-20 rule is one of the most extensively used and simple to understand budgeting practices. According to the rule, a person’s take-home pay should be divided into three categories: needs (50%) wants (30%) and savings (20%). 50% of your income should be set aside for needs (insurance, children’s education), the next 30% of your income can be used to fulfil wants (pursuing a hobby, taking a vacation), and the remaining 20% must be allocated towards savings and investments.

The simplicity of the rule resides in its ease of comprehension and application, which allows each person to set aside a specific part of their monthly income for savings. People should keep track of their expenditures, especially if they have difficulty saving money at the end of each month.

2) First (1st) Week Rule

The First Week Rule is a smart way to manage your money. It suggests saving and investing 20% of your income right at the beginning of the month, i.e., in the first week itself. This early action helps you build a habit of responsible financial behaviour.

For impulsive shoppers, the rule advises waiting a week before buying something shiny and new. Take that time to think about the purchase’s value, potential return, and if there are better ways to use the money. If you still feel strongly about it after a week, go ahead. But often, this pause helps you realize you don’t really need it, saving you money in the long run.

3) The 6X Emergency Rule

To be on a safer side, it is always recommended to keep at least six times the amount of money that you spend in a month towards your emergency fund. This money can help you out if something goes wrong like losing a job or a sudden medical emergency. For example, if your monthly expenses are Rs 50,000 lakh, you should keep Rs 3 lakh in your bank account to take care of unforeseen circumstances.

4) 40% EMI Rule

Another rule to help you keep your finances in check is the 40% EMI rule. Debt management is a critical part of financial well-being. The 40% EMI mantra suggests that the total debt / EMI that you pay towards a loan or credit card payment should not exceed 40% of your net income. Simply said, if you plan to buy a house (or anything else) with a take-home income of Rs 1 lakh, make sure the EMI is less than Rs 40,000. This guarantees that you have enough room in your budget for other necessary costs and savings.

5) 20X Term insurance

Now, let us now discuss the “20x term insurance rule.” Life insurance isn’t something we like to think about, yet it’s an essential component of a sound financial strategy. Assume you are the breadwinner in your household and earn Rs 5 lakh per year. According to the 20x rule, you should consider purchasing a life insurance policy that pays out Rs 1 crore in the event of the unthinkable. Why one crore rupees? It’s as simple as Rs 5 lakh x 20.

6) Rule of 72

Speaking of investment, let’s meet the rule of 72. This rule serves as your crystal ball for predicting when your investments will double in value. It calculates the number of years it will take to double your money at a certain rate of return.

Assume you’ve invested Rs 1,00,000 in an investment that pays you 12% per year. Simply divide 72 by 12, and you’ll discover that your money will double in around six years. That original Rs 1,00,000 will grow into Rs 2,00,000. Similarly, if you get 4% interest, divide 72 by 4 to get the number of years it will take to double the money, which is 18 years.

7) The 100-age rule

The next rule is the “100-age rule”. It is similar to choosing the correct ingredients for a meal. Your assets are the ingredients in this situation, and the recipe is your financial future. The rule is simple: you need to subtract your age from 100 to get the amount of your funds that should be invested in riskier assets such as equity. So, if you’re a healthy 32-year-old, the rule suggests investing roughly 68% of your savings in the stock market and the remaining 32% in safer assets such as debt mutual funds or FDs.

8) Rule of 70

Another excellent rule for planning your money is the rule of 70 – a secret weapon against the hidden threat to your wealth, i.e., inflation. Inflation erodes the value of your money over the period of time.

Now, here’s the secret. The rule of 70 helps you determine as to when your money will lose half its purchasing power. If the inflation rate is 6%, you need to just divide 70 by that percentage (6). The result, 11.67, tells you that your money’s purchasing power will cut in half due to inflation in roughly 11.67 years to come.

Knowing this, you can make clever choices with your investments to stay ahead of inflation’s game and make sure your money keeps its value over time.

9) Rule of 25

Let’s now talk about the rule of 25. According to this rule, you should aim to save a total amount equal to 25 times your annual expenses before considering retirement.

Here’s a simple breakdown: If your yearly expenses amount to 16 lakhs, the Rule of 25X suggests contemplating retirement once you have a savings corpus of Rs 4 crore (16 lakhs multiplied by 25). It’s important to note that this isn’t a strict deadline but more of a milestone to help guide your journey toward financial independence in retirement.

10) The 4% Withdrawal rule

Another golden rule to help you preserve your retirement savings is the 4% withdrawal rule. According to this rule, if you have a Rs 1 crore retirement fund, you can withdraw Rs 4 lakh (4% of 1 crore) in the first year of retirement. To keep up with rising prices, you can increase your annual withdrawal by the inflation rate. For instance, if inflation is 5%, you’d withdraw Rs 4 lakh 20 thousand in the second year and Rs 4 lakh 41 thousand in the third year, and so on. The idea is to strike a balance: withdrawing enough for your needs while ensuring your money lasts throughout your retirement period, i.e., for about 30 years to cover expenses.

Looking for a Financial Advisor?

Connect with Fincart for personalized financial advisory services and achieve your financial goals with confidence.

Final words

Remember, these thumb rules do not depict a “one size fit all” solution. They are more like stars in the night sky that guide you through the darkness but allow you to chart your own course of action.

Your financial journey is like a unique adventure and these rules are like your helpful guides. They are not strict rules, but they will point you to move in the right direction when you are a bit lost in the money maze. So, by incorporating these 10 financial rules into your life, you can simplify the process of managing money and working towards your financial goals.