In October 2024, India’s mutual fund industry celebrated a historic achievement, as monthly inflows from systematic investment plans (SIPs) crossed ₹25,000 crore for the first time, reaching a record high of ₹25,323 crore. This figure, a marked increase from September’s ₹24,509 crore, signifies a growing trend among Indian retail investors toward disciplined, long-term wealth creation through mutual fund SIPs.

Key Milestones and Data Highlights

1. October Record: Monthly SIP inflows reached ₹25,323 crore, marking a significant leap from ₹24,509 crore in September 2024.

2. Year-on-Year Growth: October 2024 inflows represented a substantial increase from ₹16,928 crore in October 2023, reflecting strong annual growth in retail participation.

3. SIP AUM: Assets under management (AUM) through SIPs recorded an impressive ₹13.30 lakh crore in October, setting another high.

4. SIP Account Numbers: The number of active SIP accounts surged to an all-time high of 10.12 crore in October, up from 9.87 crore in September. Net new accounts created also hit a record, with 24.9 lakh accounts added during the month.

5. New SIPs registered: The number of new SIPs registered in October 2024 stood at 63.69 lakh.

6. Sector-Wide Growth: Open-ended equity mutual fund inflows also surged by 21.69% month-over-month, totalling ₹41,887 crore in October 2024 across the equity segment, which further underscores investor confidence

Data Table (Details as per AMFI)

| Month | SIP Inflow (₹ Crore) | SIP Accounts (Crore) | SIP AUM (₹ Lakh Crore) |

| October 2024 | 25,323 | 10.12 | 13.30 |

| September 2024 | 24,509 | 9.87 | 13.81 |

| August 2024 | 23,547 | 9.61 | 13.38 |

| July 2024 | 23,332 | 9.33 | 13.09 |

This data shows a clear upward trajectory in SIP contributions. The gradual increase in monthly contributions highlights both growing financial awareness and a stable rise in SIP popularity across demographics.

Factors Driving SIP Growth

Increased Financial Literacy: Campaigns by AMFI, financial institutions, and other stakeholders have bolstered financial awareness, especially among younger investors and those in smaller cities.

Digital Accessibility: Fintech innovations have made SIPs more accessible, allowing investors to open accounts, manage contributions, and access real-time fund information through digital platforms.

Market Confidence: Despite global uncertainties, the Indian stock market’s resilience has strengthened investor trust in mutual funds as a viable avenue for wealth generation. Additionally, the presence of new fund offers (NFOs) and thematic schemes in sectors like technology and infrastructure has added diversity to investment options, attracting new investors and encouraging higher SIP commitments.

Expanding Retail Participation: Growth in SIPs has not been limited to metros; semi-urban and rural areas have shown increasing SIP adoption, driven by targeted financial awareness campaigns. This increased participation is largely due to rising financial literacy and a strong push from mutual fund distributors and financial advisors, encouraging SIPs as a reliable long-term investment tool.

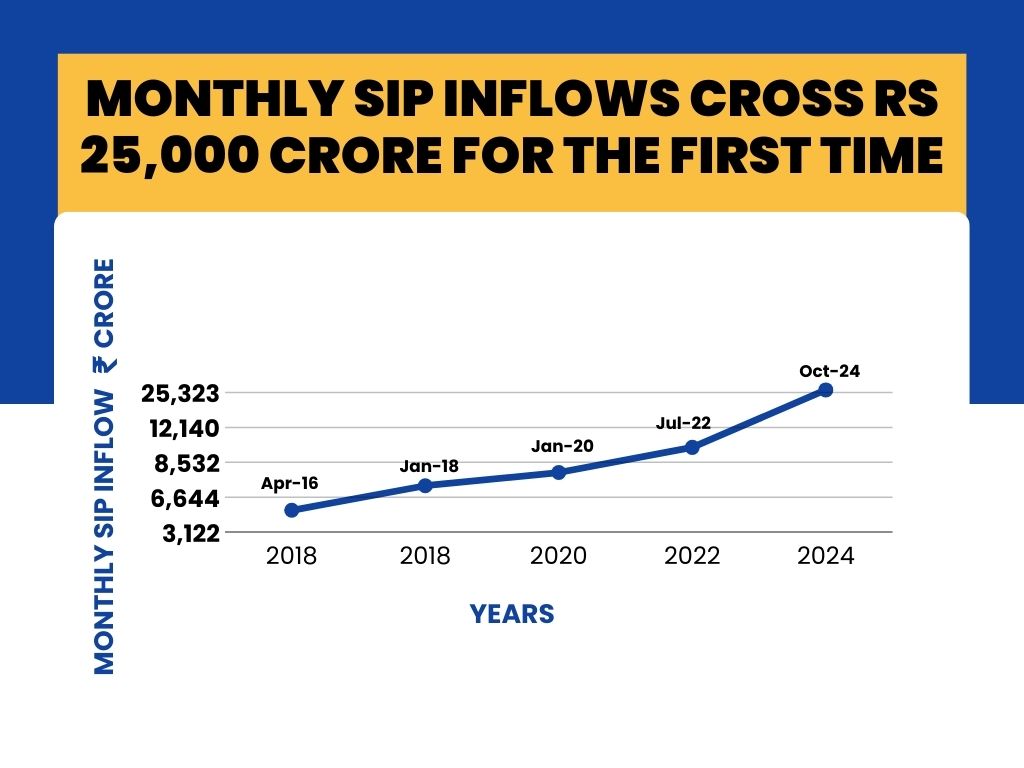

A Glance at SIP Growth Over the Years

The journey of SIP inflows has been remarkable. From ₹3,122 crore in 2016, monthly SIP contributions surged to ₹8,532 crore by 2020. Post-COVID, as markets recovered and financial literacy improved, monthly SIP inflows breached ₹10,000 crore for the first time in 2021 (₹10,351 crore in September 2021). In April 2024, SIP contributions crossed the ₹20,000 crore threshold (₹20,371 crore), setting the stage for October’s unprecedented ₹25,323 crore mark.

Broader Implications

With over 10 crore active SIP accounts and growing AUM, India’s mutual fund landscape is set for further expansion. The mutual fund industry is expected to hit ₹100 lakh crore in total AUM by 2030, which will likely be driven by continued SIP growth and a steadily increasing investor base.

Conclusion

This record-breaking SIP inflow is a powerful indicator of the transformation in India’s retail investment culture. With mutual funds becoming a mainstream choice for long-term wealth creation, SIPs represent both a financial tool and a vehicle for fostering disciplined financial habits across diverse demographics. As more Indians adopt SIPs, the mutual fund industry is poised to play an even larger role in shaping the financial security and growth of the nation’s households.