Table of Contents

Toggle“Education is the key to unlocking the world, a passport to freedom” – Oprah Winfrey.

Parenthood comes with an instinct to give the best to your child. From schooling to getting higher education, parents shell out a large portion of their savings to provide the best education.

Even though education bears the utmost importance and serves as a priority the costs become a major concern. Thus, a financial planner can help you to smooth your journey for educating your child. Getting a child education plan will not only provide financial aid to your child but also save your pocket to shell out that extra money.

The schooling you would still manage, but over the decades higher education costs have soared three-fold. Not only the education but the cost of living takes a major crunch of money too!

Well, in this blog, we’ll be discussing how you could afford your child’s college education cost.

Plan your child’s education cost

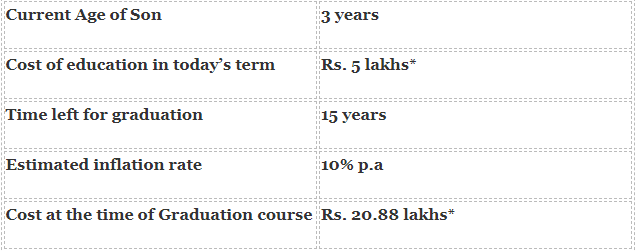

Mr.Kumar has a 3-year-old son who will be graduating in 15-16 years. He wants his child to pursue engineering in the following years. Now considering the estimated cost of the engineering course, it is somewhere between Rs. 5 lakhs. The question that arises is how much will it cost to send his son to engineering college in the coming 15 years.

As per this table, the education cost will rise to Rs. 20.88 lakhs after 15 years. This rise is solely due to inflation. Thus, it is extremely crucial to consider inflation when calculating the cost of education. To fulfill this financial goal, he would be required to make an investment & take up a child education plan & invest Rs. 4,180 per month, assuming a return of 12% p.a.

As per this table, the education cost will rise to Rs. 20.88 lakhs after 15 years. This rise is solely due to inflation. Thus, it is extremely crucial to consider inflation when calculating the cost of education. To fulfill this financial goal, he would be required to make an investment & take up a child education plan & invest Rs. 4,180 per month, assuming a return of 12% p.a.

However, if this investment is further delayed eventually the investment amount would increase to what it is now. Planning early will not let you compromise your child’s future dreams and aspirations.

Decide your time horizon

As stated earlier, the other important thing to consider is the time horizon you have left.

So make sure to calculate the years left for your child’s graduation, post-graduation, and if further higher education is required.

The longer the time horizon you have for your child’s graduation or post-graduation, the better it is for you to plan and invest. Don’t wait for the longest hour to invest as at the last moment you will end up paying more amount than you wished for.

List down your assets & liabilities

To exactly know where you stand today calculating your assets and liabilities is the best way to know about it.

For instance, you need a corpus of Rs. 1.20 crores for your daughter’s education in say 3 years. Now to achieve this, if you were to invest in debt (due to the risk involved in equities), your investment would be somewhere around Rs 2.98 lakh per month in a debt mutual fund, earning 7% post-tax returns.

Now the question is, is it feasible, considering that you have other goals like your retirement planning to invest for? No.

Hence, first, analyze other investments that are already in running that might help you to accumulate the desired amount. It is very important to first assess the current value of current investments before making any further investments.

Be sure to avoid dipping into investments made for another financial goal, like retirement while planning for your child’s education. Simultaneously, you must also not dip into the investments made for your child’s education for other low-priority expenses like renovating your home or say planning a foreign trip, etc.

Plan your investments smartly

Now the next step would be to save and invest your hard-earned money smartly. The smartest ways of investing are considered to be designing asset allocation and then investing accordingly.

Since by now you have made an account of the existing investments that could map towards planning your investment smartly. Depending upon your asset allocation pattern and risk appetite to counter inflation, invest your hard-earned money in suitable investment avenues.

For a time horizon of greater than five years, park your money in equity mutual funds. This is because these funds can provide higher returns over the long run. But be sure to rebalance your investment portfolio in a debt mutual fund as you near your goal.

It’s very simple, a well-planned asset allocation raises your portfolio returns exponentially. It is nothing but a shield to protect the value during shaky economic conditions and market volatility.

Also Read: What are The Best Investment Options For Your Child’s Future?