Do you ever feel like no matter how much money you make or how many things you buy, you never seem to be any happier? You might be caught in what psychologists call the “hedonic treadmill.” It’s like running on a treadmill – you keep moving, but you never really get anywhere.

What is the Hedonic Treadmill?

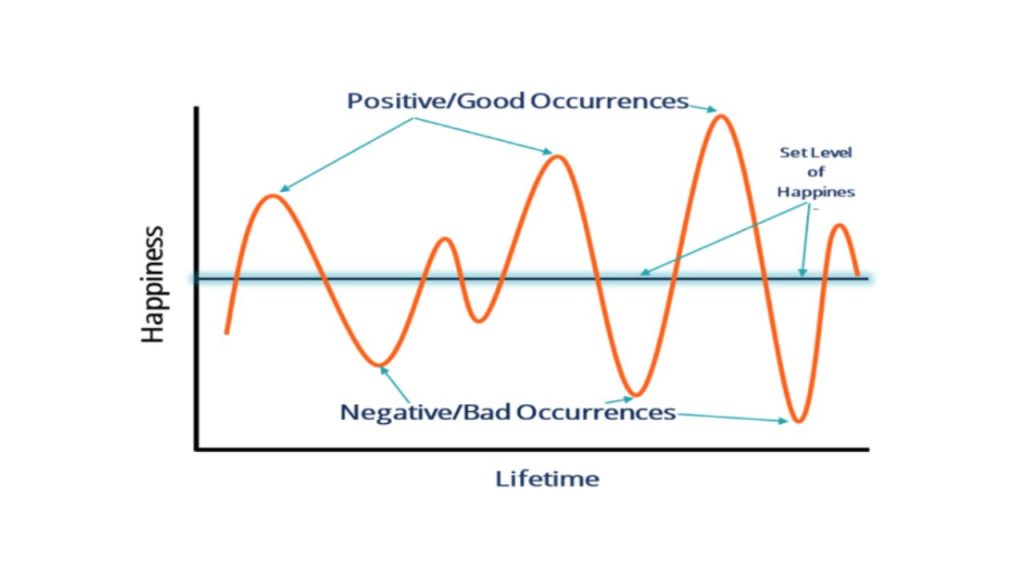

The hedonic treadmill is a psychological phenomenon where people consistently return to a relatively stable level of happiness, despite major positive or negative events in their lives. This means that even if we get a raise at work or buy a new car, we quickly adapt to these changes and our happiness levels return to the baseline.

Initially, these events may lead to a significant increase or decrease in happiness, but over time, we tend to adapt and return to our baseline level of happiness.

For example, winning a lottery can bring immense joy and excitement, but as the novelty wears off and we become accustomed to our newfound wealth, the initial happiness fades, and we return to our previous level of contentment. Similarly, experiencing a loss or setback may cause intense feelings of sadness or despair, but as time passes, we gradually adjust and return to our baseline level of well-being.

How Does it Affect Our Finances?

The problem with the hedonic treadmill is that it can lead to poor financial decisions. We may constantly chase after more money and possessions in an attempt to increase our happiness, only to find that it’s never enough. This relentless pursuit can result in overspending, accumulating debt, and experiencing financial stress.

The problem lies in our tendency to adapt to new circumstances and possessions quickly. What initially brings us excitement and happiness soon become the norm, and we find ourselves seeking the next purchase or financial milestone to attain that same level of satisfaction. However, this cycle of consumption is unsustainable and can lead to a downward spiral of financial instability.

Tips for Breaking Free:

1. Practice Gratitude: Instead of focusing on what you don’t have, take time to appreciate what you do have. Keeping a gratitude journal can help you cultivate a more positive outlook on life without relying on material possessions.

2. Set Meaningful Goals: Rather than chasing after fleeting pleasures, set goals that align with your values and bring long-term satisfaction. This could include saving for a trip, investing in your education, or donating to a cause you believe in.

3. Practice Mindfulness: Be present in the moment and pay attention to your thoughts and feelings. Mindfulness can help you become more aware of your spending habits and prevent impulse purchases driven by the desire for instant gratification.

4. Focus on Experiences Over Things: Invest in experiences rather than material possessions. Research shows that experiences tend to bring more lasting happiness than buying stuff. So instead of buying the latest gadget, consider spending your money on a weekend getaway or a cooking class with friends.

5. Live Within Your Means: It’s important to live within your means and avoid comparing yourself to others. Just because someone else has a bigger house or a fancier car doesn’t mean you need to keep up. Focus on what’s truly important to you and prioritize your spending accordingly.

6. Differentiate Between Needs and Wants: Before making a purchase, ask yourself if it’s something you truly need or just something you want in the moment. Learning to distinguish between necessities and frivolous indulgences can help curb impulse spending.

7. Avoid Comparison with Others: It’s easy to feel pressured to keep up with the Joneses, but comparing yourself to others only fuels the desire for more material possessions. Focus on your own financial goals and priorities instead of trying to compete with others.

8. Invest in Yourself: Instead of seeking happiness through material possessions, invest in experiences and activities that promote long-term well-being. Whether it’s pursuing a hobby, learning a new skill, or investing in your health, focus on activities that provide lasting fulfilment.

9. Practice minimalism: Embrace a minimalist lifestyle by decluttering your belongings and focusing on what truly adds value to your life. By simplifying your surroundings, you’ll reduce the desire for unnecessary purchases and cultivate a greater sense of contentment with less.

10. Delay Gratification: Practice delaying gratification by implementing a “cooling-off period” before making non-essential purchases. This allows you to reconsider whether the item is truly worth the cost and whether it aligns with your long-term goals.

Conclusion

Breaking free from the hedonic treadmill isn’t easy, but by making conscious choices and prioritizing experiences over possessions, you can protect your finances and find greater satisfaction in life. Remember, true happiness doesn’t come from how much money you have or what you own – it comes from within.