Microsoft founder Bill Gates once remarked, “If you are born poor, it is not your fault. However, it is entirely your fault if you die poor.” This statement underscores the importance of planning for your financial future, particularly retirement. By planning early and systematically, you can ensure that you are financially secure and independent during your retirement years. The earlier you start, the better your chances of achieving this goal.

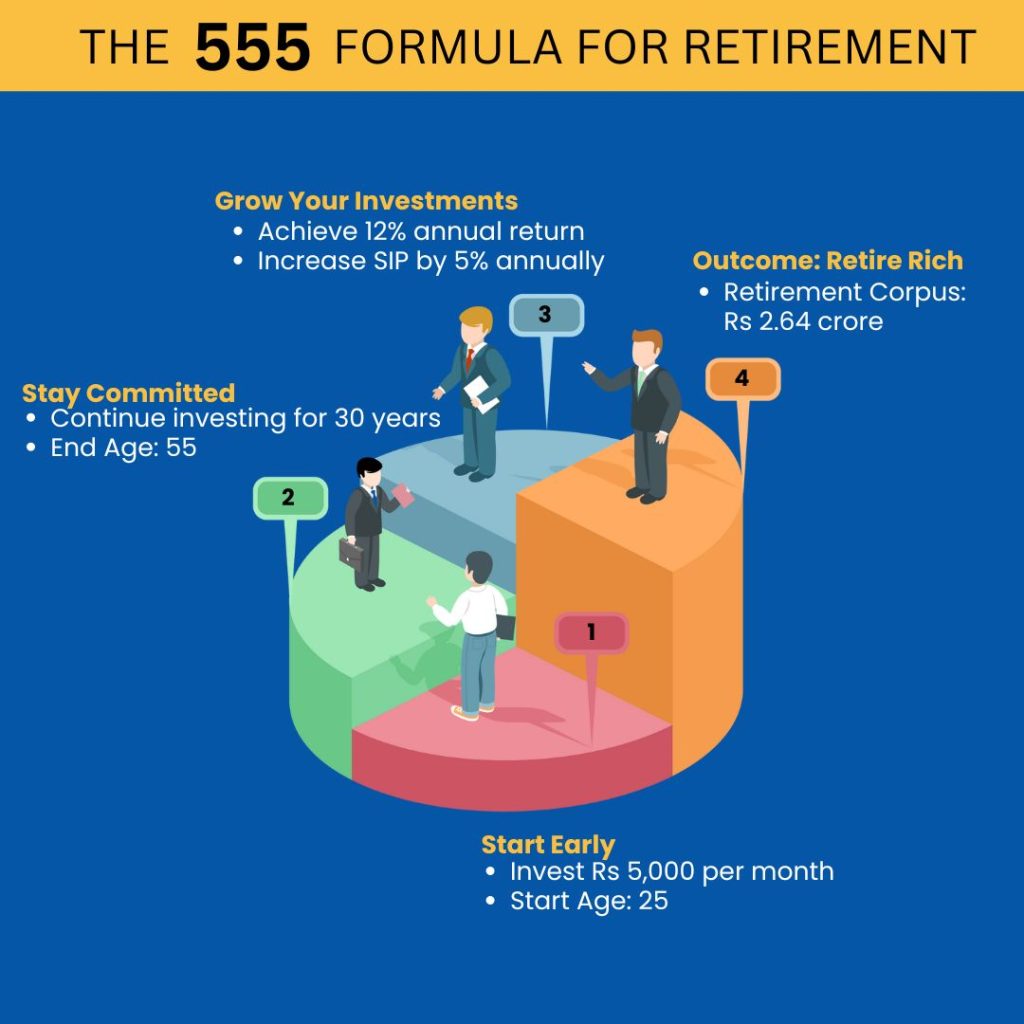

Understanding the 555 Rule for Retirement

Everyone dreams of retiring with enough money to live comfortably for the rest of their lives. Achieving this goal doesn’t require striking it rich overnight or inheriting a fortune. Instead, it’s about consistently investing small amounts over time. The key to success lies in starting early and maintaining discipline in your investment strategy.

The 555 rule is a straightforward approach to retirement planning. It suggests that if you start investing Rs 5,000 per month at age 25, you could accumulate a corpus of Rs 2.64 crore by age 55. This calculation is based on a modest annual return of 12 percent, compounded over time.

However, if you were to use an online SIP (Systematic Investment Plan) calculator to check this claim, you might find that the final amount is only Rs 1.76 crore, not Rs 2.64 crore. The difference comes from the third “5” in the 555 Formula, which involves a 5 percent annual increase in your SIP contribution, often referred to as an annual “step-up.” By gradually increasing your investment amount each year, you can reach the target of Rs 2.64 crore.

How the 555 Formula Works?

Let’s break it down further. Suppose you start an SIP of Rs 5,000 per month at age 25 and continue investing for 30 years until you turn 55. If you increase your SIP contribution by 5 percent each year, you’ll meet the Rs 2.64 crore target with a 12 percent compound annual growth rate (CAGR).

In this scenario, your total investment over the 30 years would be Rs 39.86 lakh, with the remaining Rs 2.23 crore coming from investment returns. This example illustrates how small, consistent contributions, combined with annual increases, can grow into a substantial retirement fund.

| Year | Monthly SIP (Rs) | Annual SIP (Rs) | Cumulative Investment (Rs) | Corpus (Rs) |

| Year 1 | 5,000 | 60,000 | 60,000 | 64,047 |

| Year 2 | 5,250 | 63,000 | 1,23,000 | 1,39,418 |

| Year 3 | 5,512 | 66,150 | 1,89,150 | 2,27,711 |

| … | … | … | … | … |

| Year 30 | 20,581 | 2,46,968 | ₹39,86,331 | 2,63,67,030 |

Can You Retire Earlier Using the 555 Formula?

What if you want to retire earlier, say at 50 instead of 55? Is it still possible to accumulate Rs 2.64 crore? There are three ways you can try to achieve this:

1. Increase the Monthly SIP Contribution

2. Increase the Annual Step-Up Percentage

3. Aim for Higher Investment Returns by Taking on More Risk

Let’s explore the first two options.

Scenario 1: If you stick to a 5 percent annual step-up, how much higher would your returns need to be to reach Rs 2.64 crore by age 50? With only 25 years to invest, you would need to achieve a CAGR of 15.95 percent, which is highly ambitious and perhaps unrealistic.

Scenario 2: A more achievable approach would be to increase your starting SIP amount while keeping the returns at 12 percent CAGR. To reach Rs 2.64 crore by age 50, you would need to start with a SIP of Rs 9,700 per month and continue increasing it by 5 percent each year. Essentially, you would need to double your initial SIP contribution.

Retiring early by enhancing your returns or dramatically increasing your annual step-up may not be feasible for most people. A more practical solution is to start with a higher initial SIP.

| Scenario | Starting SIP (Rs) | Annual SIP Step-up | CAGR (%) | Final Corpus (Rs) |

| Retire at 55 (Original Plan) | 5,000 | 5% | 12% | 2.64 crore |

| Retire at 50 (Higher SIP) | 9,700 | 5% | 12% | 2.64 crore |

| Retire at 50 (Higher Return) | 5,000 | 5% | 15.95% | 2.64 crore |

Want a worry-free and comfortable retirement?

Plan your golden years with Fincart’s retirement planning services and retire with peace of mind.

Don’t Delay Your Retirement Planning

The most crucial factor in building your retirement corpus is time. The earlier you start, the better. Let’s consider an example. If you start investing Rs 10,000 per month at age 25 and increase it by 5 percent annually, with a 12 percent CAGR, you could accumulate Rs 5.27 crore by age 55. Interestingly, your corpus would double in the last five years (50-55), highlighting the importance of allowing your investments enough time to grow (the corpus would be Rs 2.73 crore if you stay invested for only 25 years).

The takeaway is clear: begin your retirement planning as early as possible and stay committed to it for about 30 years. That’s how the 555 Formula can help you secure a comfortable and financially independent retirement. Use our retirement planner calculator to project your savings, investments, and retirement goals.