Table of Contents

ToggleRetirement is the age that proffers you the time to catch up with things that you might have missed out on early due to personal & professional commitments. Well, surely retirement also means no more worries about achieving monthly targets or working on urgent deadlines, or cruising through traffic during rush hours! Instead, you get an ample amount of free time to do the things you’ve always wanted. Both the National Pension Scheme (NPS) & Public Provident Fund (PPF) have been regarded as a good addition to your retirement plan. But when considering the two, let’s see which comes out to be better for retirement.

What is a National Pension Scheme (NPS)?

National Pension Scheme is an initiative of social security that is a government-owned investment option. The purpose of NPS is to meet the financial needs of employees of private, public, or unorganized sectors for their retirement. This scheme was first introduced by the central government and later on, it was introduced to all the citizens of India between the ages of 18-60 years.

With NPS, the investors invest a portion of their income at regular intervals. Through this scenario, NPS allows you to accumulate your retirement corpus. Accordingly, you will be able to get a pension during your retirement years. The minimum amount to start investing in NPS starts from Rs.500 up to no limit. However, the thing to consider here, is that withdrawals can only be made once you have reached the age of 60.

The best part of investing in NPS is that it comes with additional tax benefits. For instance,

-

- Under section 80CCE a deduction up to Rs. 1,50,000 can be claimed;

- Under section 80CCD(1B) up to Rs. 50,000 can be claimed;

- Lastly, under section 80CCD(2) up to 10% of the basic salary can be claimed.

In addition to tax benefits, NPS gives the liberty to invest up to 75% of your fund in equity. Since NPS is a market-linked investment, it can beat inflation with its returns over the long term. Therefore, a best-suited financial product in helping secure the golden years of the investors.

Who can invest in NPS?

The National Pension System (NPS) is accessible to all Indian citizens aged between 18 and 70 at the time of submission of their application. Prospective account holders must adhere to Know Your Customer (KYC) norms and should not be an undischarged insolvent or of unsound mind.

What is the Public Provident Fund (PPF)?

PPF or Public Provident Fund has been quite a popular government-funded scheme introduced in 1968 by the Ministry of Finance in India. Investors focused on PPF a lot for long-term investment horizon. However, it is recommended to stay invested for 15 years to get the best results on your investment.

The PPF’s current interest rate stands somewhere around 7.1% p.a. with the interest being compounded annually. Every 31st of March the interest gets credited to the PPF account holder’s account. The major advantage of PPF is its tax benefits that every year you claim up to 1.50 lakh under Section 80C.

Another advantage that a PPF account bears is that after 3 years of holding your account, you can take a loan against it. And if you are successful in repaying the loan before the 6th year then you become eligible for another loan!

Formerly, the premature closing of the PPF account was not there however it has been added now. However the account holder has to keep the PPF account active for a minimum of 5 years before closing the account.

Who can invest in PPF?

Investment in the Public Provident Fund (PPF) is open to all Indian citizens. However, an individual is allowed only one PPF account, with an exception for a second account in the name of a minor. Non-Resident Indians (NRIs) and Hindu Undivided Families (HUFs) are not eligible to open a PPF account.

Want a worry-free and comfortable retirement?

Plan your golden years with Fincart’s retirement planning services and retire with peace of mind.

Difference between NPS and PPF

Here’s a comparison between the National Pension System (NPS) and the Public Provident Fund (PPF):

|

Basis |

PPF |

NPS |

|

Maturity |

PPF has a fixed maturity period of 15 years. However, investors have the option to extend the account in blocks of 5 years indefinitely.

|

NPS matures when the investor reaches the age of 60. At maturity, a portion of the corpus must be used to purchase an annuity while the remaining amount can be withdrawn as a lump sum. |

|

Returns |

The interest rate on PPF is set by the government and is subject to periodic revisions. It is 7.1% for Q1 of FY 2024-25. |

The returns in NPS are market-linked and depend on the performance of the underlying investment options chosen by the investor (usually around 9-12%). |

|

Minimum investment |

The minimum annual contribution for PPF is ₹500, and investors can contribute up to a maximum of ₹1,50,000 in a financial year. |

When opening an NPS Tier I account, you will have to make a minimum contribution of Rs. 500. And for NPS Tier II account, the minimum contribution required is Rs. 1,000. |

|

Tax exemptions |

Contributions to PPF are eligible for tax deductions under Section 80C, up to a maximum limit of Rs. 1.5 lakh. Furthermore, the interest earned and the maturity proceeds are entirely tax-free. |

Investment in NPS is tax-deductible up to Rs 1.5 lakh under Section 80C. You can also get an additional tax deduction of Rs. 50,000 under Section 80CCD(1B) for NPS.

|

|

Withdrawals |

Partial withdrawals from PPF are allowed after the completion of 5 years from the end of the financial year in which the account was opened. |

NPS allows partial withdrawals under specific conditions such as medical emergencies, higher education, home purchase, or marriage. |

|

Choose how to invest |

PPF investors do not have the option to choose specific investments. |

Investors have the flexibility to choose between different investment options such as equity, corporate bonds, and government securities. |

NPS vs PPF: Which is better for Retirement?

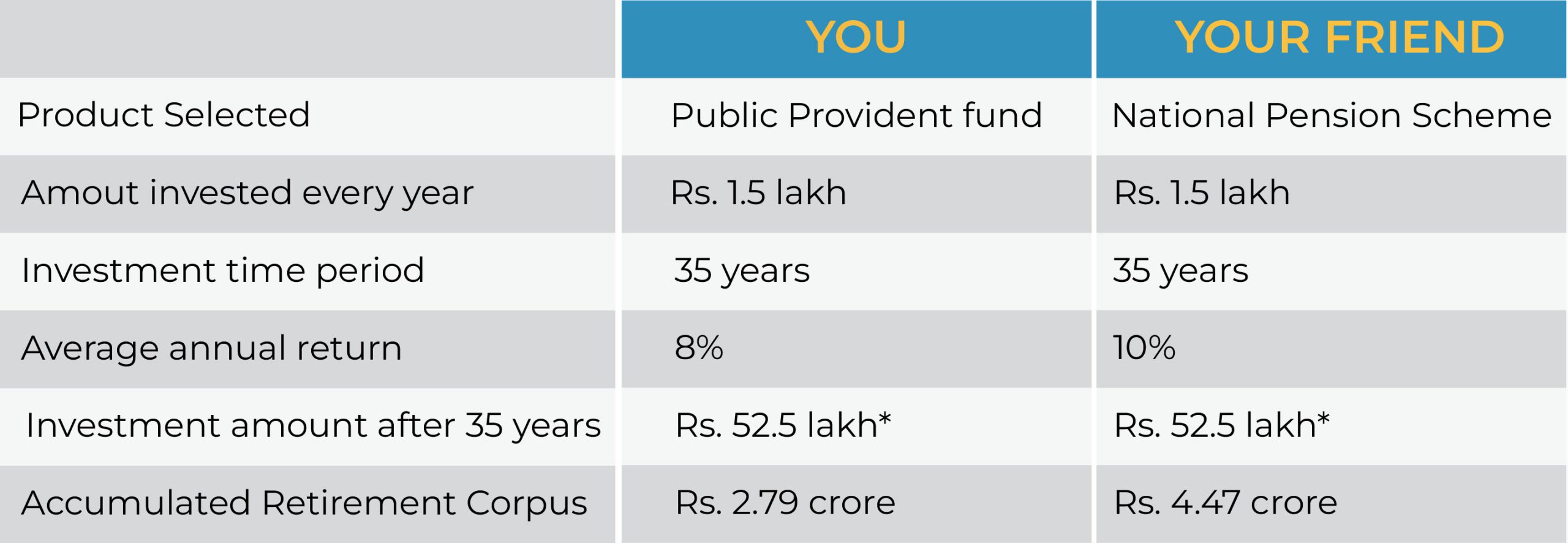

As both these products, NPS & PPF are good for an additional retirement plan, NPS is believed to be more beneficial. How? Well, let’s understand this through an example:

Now consider you and your friend both have savings of Rs. 1.5 lakh for their retirement in say, 2019 and you both wish to continue your investments till the end. You both are 25 years old and both have plans to retire by 60 years of age. However, you ended up investing in PPF whereas your friend invested in NPS. Check out the table mentioned below and see whether you or your friend wins this retirement planning:

The reason behind the difference in accumulated retirement corpus was the power of compounding. Also, for the past few years, the interest rate of PPF has seen decreasing. Whereas for NPS, the estimation is that it will give a 10% interest rate in the coming future.

BOTTOM LINE:

Both retirement schemes do have the power to generate returns by the time you reach your retirement age. However, NPS has a bigger foot here as it has the power to beat the inflation rate & create a substantial retirement corpus in the long term.

faq's

1. Which one offers better tax benefits, NPS or PPF?

PPF operates under the EEE (Exempt-Exempt-Exempt) category, ensuring tax exemption on the invested amount, interest earned, and maturity proceeds. In contrast, NPS has a partially taxable maturity, with annuity income being subject to taxation.

Both NPS and PPF qualify for a deduction of up to Rs. 1.5 lakh under Section 80C. Notably, NPS offers an extra advantage with an additional deduction of up to Rs. 50,000 under Section 80CCD(1B), making it more tax-efficient.

2. What is the Eligible age of investment in NPS and PPF?

For NPS, individuals between 18 and 70 years of age are eligible. In contrast, there is no age limit for PPF, allowing individuals of any age to invest. Additionally, a minor can have a PPF account, managed by a guardian until the minor reaches 18 years of age.

3. Which one is more suitable for retirement planning, NPS or PPF?

When choosing between NPS and PPF for retirement planning, NPS is generally more suitable for those seeking higher returns and flexibility in their investment. NPS offers market-linked returns with exposure to equities, providing the potential for greater growth over time. On the other hand, PPF is a safer, government-backed option with guaranteed returns and tax-free interest, making it ideal for risk-averse individuals.

4. Can I have NPS and PPF both?

Yes, you can consider investing in both NPS as well as PPF.

5. Which one is better, PPF or NPS?

If you’re seeking government-backed returns with tax benefits under Section 80C, the Public Provident Fund (PPF) is a great option. However, if you’re looking for extra tax advantages along with market-linked returns, the National Pension Scheme (NPS) is a better choice, offering both long-term growth potential and tax savings.