Table of Contents

Toggle‘Money’ is not everything but ‘Everything’ needs money! If we decode this saying we will understand that to lead a purposeful and satisfactory life we need money at every step of our life. From necessities to ultimate luxuries, from today to the future, everything depends on how effectively we carve our financial planning. Why Financial Planning? A life without financial planning is like a rudderless ship on a shoreless sea!

Having investment strategies gives meaning to your life, establishes a motivational goal for which you put in effort, & promotes a sense of financial security.

Best financial planning is one that provides a direction to your dreams along with providing cushioning to your investment from domestic or global upheavals.

Are there any golden rules?

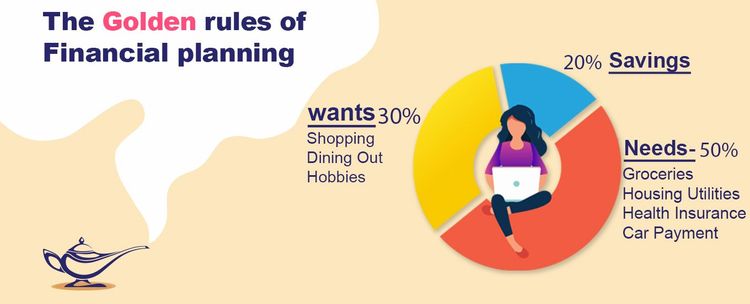

A well-defined investment strategy is essential to give a method to the money madness. If research is done right then every process can be identified with a few sets of golden rules. The same applies to financial planning as well. So are you ready to dive deeper? If yes, scroll down!

1. Develop the Saving habit

Wealth is largely the result of habit!

Developing a habit of saving money is quintessential; a predetermined sum of money kept aside every month is the first step to realizing your financial planning.

2. Set up Goals

Well-defined goals, both short-term & long-term, will bring the needed clarity on how much money will be needed and when. These goals will decide your saving pattern & investment needs, and taking the assistance of a financial planning company is advisable as various factors like your age, earnings, liabilities, risk appetite, etc. have to be considered.

3. Have a Concrete Plan

All you need is the plan, the road map, and the courage to press on to your destination!

Financial planning is like a maze puzzle game where you have a collection of paths but only one of them leads to the goal. Similarly, there are numerous tools of investment available, and selecting the right combination is the key to the success of your financial plan.

4. Start Young

Just as a sprinter goes ahead of his rivals due to early lead, in the same way starting at an early age is key to the success of your financial planning.

5. Cover Risks

Investing adequately in life insurance, and health insurance should be given equal importance in your financial planning. Emergency funds must also be an integral part of it so that your savings & investments are secure even during unforeseen emergencies like the one we are facing now- COVID-19.

These golden rules are hints, subjective to the individualistic approach- ‘To each his own’.

To create a financial blueprint that will spell sure success for ‘you’, seek help from the players of this market- Team Fincart is always ready to help you!