“The secret to getting ahead is getting started. The secret to getting started is breaking your complex, overwhelming tasks into small manageable tasks, and then starting on the first one.”

Investing is often seen as a complex task, especially when markets fluctuate. But with a Systematic Investment Plan (SIP), you can break this task into manageable pieces, allowing you to invest regularly without worrying about market timing. One of the greatest advantages of SIP is rupee cost averaging, a simple yet powerful strategy that helps you buy mutual fund units at an average cost over time, regardless of market conditions. In this article, let’s explore how SIP and rupee cost averaging can work together to build wealth.

What is Rupee Cost Averaging?

Rupee Cost Averaging works on the principle of buying more units when the market is down and fewer units when the market is up. This helps in lowering the overall cost of investment. Since the investor continues investing a fixed sum regularly, it removes the need to time the market.

Here’s how it works:

· Consistent Investment: You invest the same amount periodically.

· Unit Price Fluctuation: The price of the mutual fund units may rise or fall over time.

· More Units When Low, Fewer When High: You acquire more units when the price is lower and fewer units when the price is higher.

· Average Cost Reduction: Over time, the average cost per unit tends to be lower than the average market price, thanks to purchasing more units at lower prices.

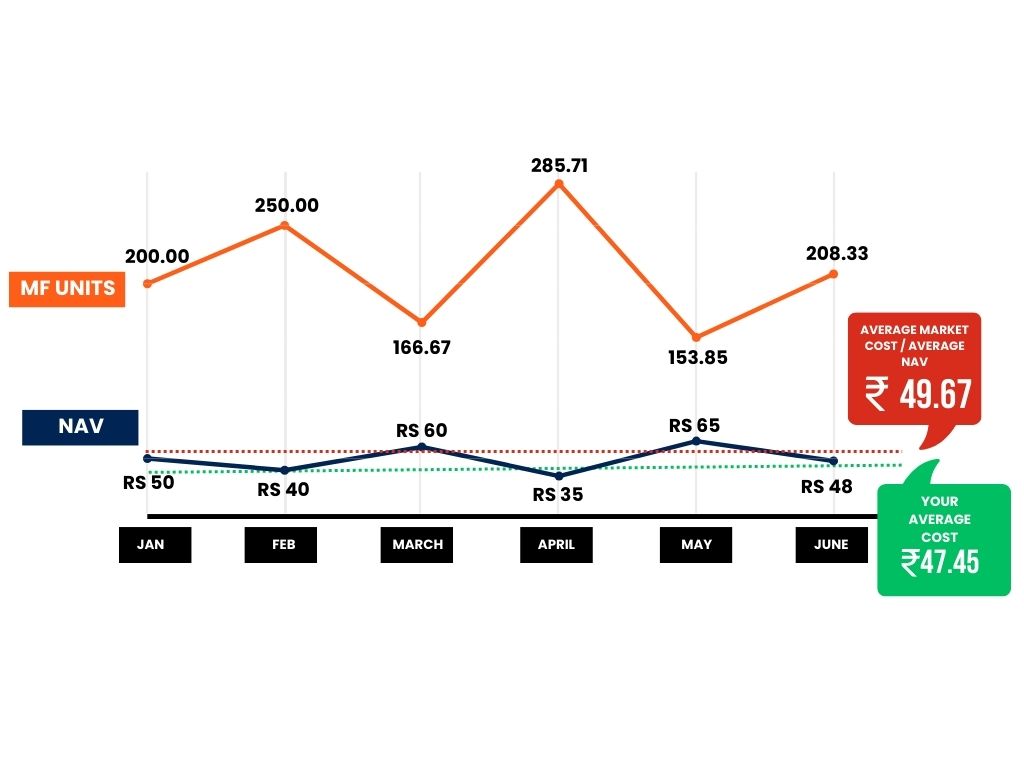

Let’s consider a scenario where you invest ₹10,000 every month through SIP in a mutual fund. The following table shows the fluctuation of the Net Asset Value (NAV) of the mutual fund over 6 months.

| Month | SIP Amount (₹) | NAV (₹) | Units Purchased |

| January | ₹ 10,000 | ₹ 50 | 200.00 |

| February | ₹ 10,000 | ₹ 40 | 250.00 |

| March | ₹ 10,000 | ₹ 60 | 166.67 |

| April | ₹ 10,000 | ₹ 35 | 285.71 |

| May | ₹ 10,000 | ₹ 65 | 153.85 |

| June | ₹ 10,000 | ₹ 48 | 208.33 |

| Total | ₹ 60,000 | 1264.56 |

In January, you bought 200 units at ₹50 per unit.

In February, the market dropped, so the Net Asset Value (NAV) was ₹40. You bought more units—250 units for the same ₹10,000.

In March, the NAV increased to ₹60, so you could buy only 166.67 units.

This pattern continues, buying more units when the NAV is lower and fewer when the NAV is higher.

Total Investment Over 6 Months: ₹60,000

Total Units Purchased: 1264.56 units

Now, let’s calculate the average cost per unit and compare it with the average NAV over this period:

Average Cost per Unit = Total Investment / Total Units Purchased

Average Cost per Unit = ₹60,000 / 1264.56 = ₹47.45

Now let’s calculate the average NAV during this period:

Average NAV = (₹50 + ₹40 + ₹60 + ₹35 + ₹65 + ₹48) / 6 = ₹49.67

By investing through SIP, the investor managed to lower the average cost per unit to ₹47.45, even though the average NAV during this volatile period in the market (fluctuating from ₹35 to ₹65) was ₹49.67. This is the essence of Rupee Cost Averaging.

Now, suppose you invest the entire ₹60,000 at once in January when the NAV is ₹50.

Units Purchased = ₹60,000 / ₹50 = 1200 units

Total Value at End of June (NAV of ₹48) = 1200 × ₹48 = ₹57,600

Whereas, when you invest ₹10,000 every month for 6 months, as in the SIP example above,

Total Value at End of June (NAV of ₹48) = 1264.56 × ₹48 = ₹60,698.90

| Investment Type | Total Investment (₹) | Units Purchased | Total Value at June’s NAV (₹48) |

| Lumpsum | ₹ 60,000 | 1200 | ₹ 57,600 |

| SIP | ₹ 60,000 | 1264.56 | ₹ 60,698.90 |

With SIP, you purchased 64.56 more units than you would have with an investment made entirely at the start. This is the benefit of rupee cost averaging—by spreading your investment over time, you reduce the risk of market timing and lower the average cost per unit.

Why Rupee Cost Averaging is Beneficial

Avoids Market Timing: SIPs eliminate the need to time the market. Instead of worrying about when to invest, you automatically invest at regular intervals, which reduces the emotional stress of timing the perfect market entry.

Smoothens Market Volatility: By investing regularly, you take advantage of market fluctuations. When prices drop, you get more units, and when prices rise, your investment grows. This smoothens the impact of market volatility.

Lower Average Cost: As seen in the example, the average cost per unit through SIP was lower than the average market price during the investment period.

Compounding Benefits: SIPs, when maintained over long periods, benefit from the power of compounding. The returns on your investments are reinvested, further accelerating wealth growth.

Ready to grow your wealth?

Partner with Fincart for expert investment planning and make your money work for you.

Conclusion

SIP is a highly effective way to accumulate wealth over time without worrying about market timing. By employing Rupee Cost Averaging, SIPs help you lower the average cost of your investment, resulting in higher returns especially during volatile market conditions, making a SIP investment planner effective for optimizing your strategy.