Introduction

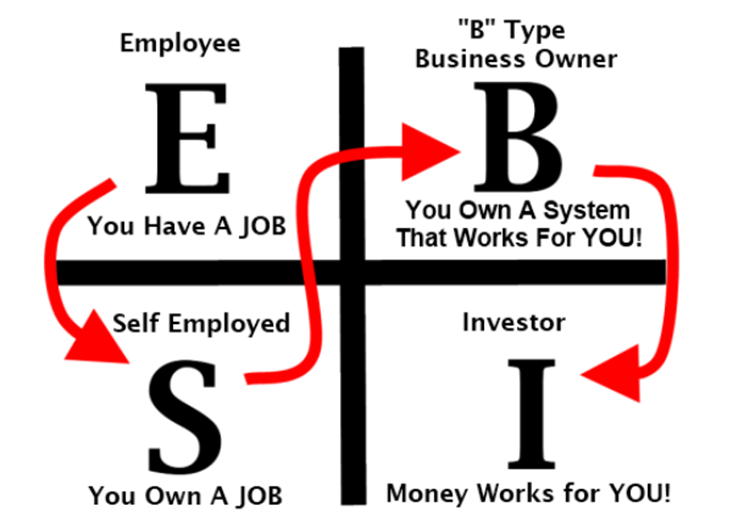

The concept of the Cashflow Quadrant was popularized by Robert Kiyosaki in his book “Rich Dad’s Cashflow Quadrant.” It is a powerful concept that categorizes the different ways people generate income. The Cashflow Quadrant is divided into four categories: Employee (E), Self-Employed (S), Business Owner (B), and Investor (I). Understanding these quadrants can help individuals navigate their financial journey and achieve financial independence.

The Four Quadrants

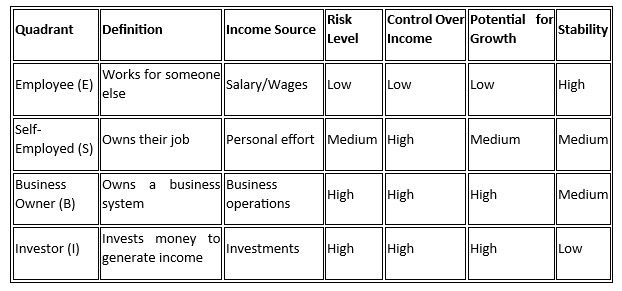

Employee (E)

Employees work for others and earn a paycheck. They exchange time and effort for money, typically receiving a steady, predictable income. Employees often enjoy benefits such as health insurance, retirement plans, and job security. However, they are generally limited by their salary and have less control over their financial future.

Income Source: Salary or wages

Time Commitment: Fixed hours

Self-Employed (S)

Self-employed individuals work for themselves. They may own a small business, work as freelancers, consultants, or professionals such as doctors and lawyers. While they have more control over their work, their income is directly tied to their effort and time, often leading to long hours and limited scalability.

Income Source: Fees, commissions, or business profits

Time Commitment: Variable, often extensive

Business Owner (B)

Business owners build systems and hire people to work for them. They leverage other people’s time and skills to generate income, allowing for greater scalability and potential passive income. Business owners focus on building and managing systems rather than working within them.

Income Source: Business profits, dividends

Time Commitment: Initial high commitment, potentially decreasing over time

Investor (I)

Investors generate income by putting their money to work. They invest in assets such as stocks, bonds, real estate, and businesses. Their income is derived from the returns on their investments, providing the potential for substantial passive income and financial freedom.

Income Source: Investment returns (dividends, interest, capital gains)

Time Commitment: Low to moderate (research and management)

The Quadrants and their Characteristics

Transitioning Between Quadrants

Robert Kiyosaki emphasizes focusing on the right side of the Cashflow Quadrant—Business Owner and Investor—to achieve significant wealth. That said, you don’t need to fully transition to another quadrant all at once. You can maintain involvement in multiple quadrants simultaneously. For example, one may start as an Employee + Investor. Starting as an Employee + Investor allows individuals to build a stable income while investing for growth. As investments grow, transitioning to a Business Owner role can further enhance financial stability and wealth. Combining Business Owner and Investor roles maximizes wealth potential through diversified income streams and reinvestment of profits.

By focusing on the right side and strategically combining quadrants, individuals can build a solid foundation for long-term financial success and wealth accumulation.

Transitioning from one quadrant to another requires a shift in mindset and strategy. Here are some tips for making these transitions:

From Employee to Self-Employed

· Develop Skills: Acquire skills relevant to your desired self-employed field.

· Build a Network: Establish a network of potential clients and mentors.

· Create a Business Plan: Outline your business goals, strategies, and financial projections.

From Self-Employed to Business Owner

· Systematize Your Business: Develop systems and processes to streamline operations.

· Hire Staff: Recruit employees or contractors to take over day-to-day tasks.

· Focus on Growth: Shift your focus from working in the business to growing it.

Looking for a Financial Advisor?

Connect with Fincart for personalized financial advisory services and achieve your financial goals with confidence.

From Business Owner to Investor

· Educate Yourself: Learn about different investment options and strategies.

· Diversify: Spread your investments across various asset classes to mitigate risk.

· Leverage Expertise: Work with financial advisors and investment professionals.

To Sum Up

The Cashflow Quadrant provides a valuable framework for understanding different income generation methods. By recognizing where you currently stand and where you aspire to be, you can make strategic decisions to achieve financial freedom. Whether you’re an employee looking to transition to self-employment or a business owner aiming to become an investor, the key is continuous learning and strategic planning.