A tale of two choices:

Rohit, a 28-year-old architect, working at a multinational in Bangalore, lives a modest lifestyle. His hard work reaped him a Rs 3,36,000 promotion last year after taxes, giving him an extra Rs 28,000 a month. Here are two paths that he could choose from for using his additional income to make lifestyle changes:

Path 1: Enjoying all the fruits of his labor now

- Upgraded to a new vehicle @ Rs 20,000 per month

- Upgraded streaming services or joined a hobby club @ Rs 4,000 per month

- Went out to eat more often @ Rs 4,000 per month

Path 2: Planting seeds for the future

- Increased emergency fund @ Rs 4,000 per month

- Made extra debt payments @ Rs 8,000 per month

- Invested more into retirement @ Rs 8,000 per month

- Increased allowance for “fun” spending @ Rs 8,000 per month

One path sees Rohit use most of his additional income to increase his financial security. Another shows an increase in his spending along with his income. This is known as lifestyle inflation and it can have a toll on you before you even know it, limiting your ability to build wealth.

Defining lifestyle inflation

Imagine, like Rohit, you got a job that you have been wanting and more importantly, it came with a pay raise that you had long been hoping for. You are extremely happy and start seeing yourself as a wealthier person. But three months later, you check your bank account and it has not grown. “What happened?” you ask yourself. “I am making more money. Why haven’t I been able to save more money?”

The culprit here is lifestyle inflation. It occurs when a person’s standard of living increases along with their increase in income. People develop a sense that they “deserve” more amenities now that they reached their career goals or feel as though they want to reward themselves. But unfortunately, this phenomenon can pose a serious risk to your wealth.

Which path should you follow?

By following Rohit along the path of putting extra income toward debt, savings and investments while still having some fun now, you can set yourself up for financial success rather than locking in a higher cost of living.

How does lifestyle inflation happen?

The above story is a perfect example. Instead of saving the majority of money from a pay raise, you might likely increase your standard of living. You could be buying that special coffee that you would not allow yourself to have before. Or suddenly you may feel that you deserve a new expensive car, even if your existing car travels from destination A to B just fine.

What triggers it?

It is not only pay raises or promotions that trigger lifestyle inflation. Several other factors might also provoke it.

- Social comparisons and the desire to keep up with friends or colleagues

- Moving to a wealthier neighborhood

- The desire for status and recognition

- Easy access to credit cards and loans which in turn facilitates spending

- With higher income, people develop a sense of entitlement to a better life and a better standard of living

- As individuals earn more, they opt for more convenient options (premium services)

From Raises to Regrets

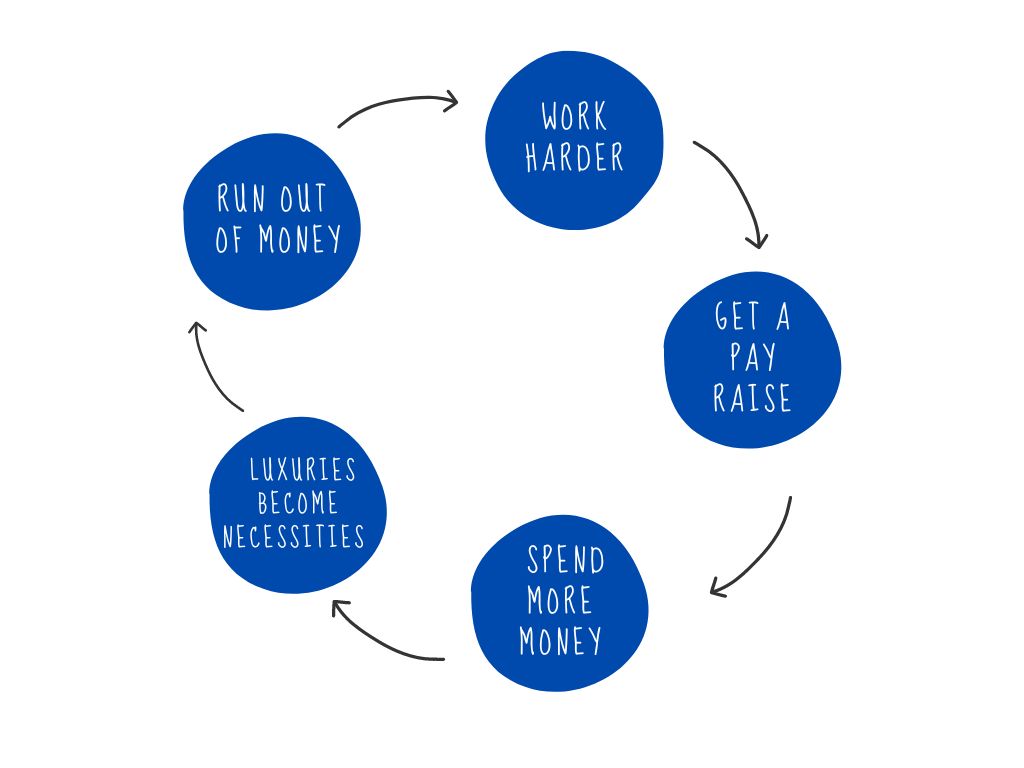

Every time you get a raise, lifestyle inflation tends to become greater. Each salary increase is often accompanied by an upward adjustment in spending. Slowly and gradually, you get into a cycle of living pay check to pay check. Though you may be able to pay your bills, your ability to convert your higher salary into a way to build wealth may get limited. In the long-run, this can prove to be regrettable as you may be left with minimal funds, debt trap and lack of resources.

Protect What Matters Most!

Contact Fincart for tailored insurance and risk management solutions to safeguard your future.

Costs associated

Lifestyle inflation can come with following costs:

- Increased financial obligations such as higher monthly bills and car loan installments

- Diminished savings as well as retirement contributions and other investments

- Accumulation of debt

- Missed opportunities (increased income could go toward investing in education or a more meaningful experience)

Will I know that I am a victim of lifestyle inflation?

Not necessarily. Lifestyle inflation tends to sneak up on people. That is why it is called lifestyle inflation. You might not be consciously aware of the fact that you have begun spending more money on luxury items that would have previously seemed to be expensive.

What can I do to prevent lifestyle inflation?

1. Maintain a budget:

Creating a budget is one of the most effective ways to combat lifestyle inflation. It allows you to take a look at your finances without getting your emotions involved.

2. Allocate to emergency and retirement fund:

Ensure that you allocate enough money to your emergency savings and retirement fund. Keep a constant focus on your long-term financial goals.

3. Celebrate smart:

You can still celebrate the fact that you got a pay raise. You just need to do it responsibly. Make incremental changes to your household furniture instead of buying all new at once.

4. Don’t do anything long-term:

Celebrate your success but make sure that it is a finite thing like a vacation, a piece of jewelry or so. Don’t indulge in long-term habits or major commitments.

5. Delay gratification:

Sometimes, it is a good idea to delay impulsive purchases by giving yourself time (maybe a day or a week) to think about whether the item is genuinely valuable or it’s just a fleeting desire.

Final thoughts

When you work hard, you deserve to treat yourself. But make sure that you do it in a way that is safe and responsible for you as well as your family’s needs.